The Board believes that a healthy corporate culture is the core of good corporate governance. China Unicom persistently enhances the development of corporate culture, and insists on strengthen and solidify, preserve and innovate, and integrate and open, deeply implements the strategies to build a strong enterprise, i.e. via technology, talent, reform, digital and smart transformation, and brand, in order to accelerate becoming a world-class technology service enterprise with global competitiveness. China Unicom plays the role of the leading contributor of digital information operation and services and the pioneer of digital technology integration and innovation. It nurtures an excellent corporate culture and consistently promotes the core values of “Customer-oriented, Employee-friendly, Attentive to quality service, Inherently innovative, Proud of endeavours, Adhering to integrity”. It also adheres to the corporate style of “Rigorous, Pragmatic, Skillful, Meticulous, Efficient”. The management philosophy of “Create value for customers, Dually driven by market and innovation, One China Unicom with integrated capabilities and operating services” has been established. The penetration and integration of China Unicom’s corporate culture philosophy into production and operation, integrating the corporate culture into the entire process of production, operation and management, which help enhancing and improving the operational effectiveness and management efficiency while ensuring the ideal corporate culture has been reflected in the company’s strategies, business models and operating practices.

The Board is committed to high standards of corporate governance and recognises that good governance is vital for the long-term success and sustainability of the Company’s business. The Board will persistently enhance the corporate governance of the Company by promoting corporate culture philosophy and core values at all levels of the Company. We hope all our executives, management and employees would implement the practice and integrate “integrity and self-discipline, uphold integrity and anti-corruption” into the ideological foundation to serve as the basic code of conduct for practitioners, while complying with laws and regulations, operates in compliance with regulations and be honest and self-disciplined. And adhering to the ethical concept and code of conduct of honesty, trustworthiness and due diligence, and strive to maximize the interests of customers, shareholders, employees and society. The scope of the relevant basic code of conduct covers matters related to legislation, regulation and ethics, including but not limited to principles of honesty and trustworthiness, conflict of interest, handling of stakeholder relations, information disclosure and confidentiality, protection of company assets, reporting and punishment. As a company incorporated in Hong Kong, the Company adopts the Companies Ordinance (Chapter 622 of the Laws of Hong Kong), the Securities and Futures Ordinance of Hong Kong and other related laws and regulations as the basic guidelines for the Company’s corporate governance. As a company listed in Hong Kong, the current articles of association are in compliance with the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited. These rules serve as guidance for the Company to improve the foundation of its corporate governance, and the Company strives to comply with the relevant requirements of international and local corporate governance best practices. The Company has regularly published statements relating to its risk management and internal control in accordance with relevant regulatory requirement to confirm its compliance with related risk management and corporate internal control requirements and other regulatory requirements. The Board is responsible for performing overall corporate governance duties. The Company has adopted a Corporate Governance Practice which sets out the key terms of reference of the Board on corporate governance functions, including, amongst others, developing and reviewing the Corporate Governance Policy and corporate governance practices of the Company; reviewing and monitoring the training and continuous professional development of Directors and senior management; reviewing and monitoring the Company’s policies and practices on compliance with legal and regulatory requirements; developing, reviewing and monitoring the code of conduct and compliance manual applicable to employees and Directors; and reviewing the Company’s compliance with the Corporate Governance Code and the disclosure in “Corporate Governance Report”.

In 2023, the Company’s continuous efforts in corporate governance gained wide recognition from the capital markets and the Company was accredited with a number of awards. The Company was voted as “Asia’s Most Honored Telecom Company” for eight years in a row in “2023 All-Asia Executive Team” ranking organised by the authoritative financial magazine, Institutional Investor. Meanwhile, the Company was also honored with “Asia’s Best Board (Telecoms)” and “Asia’s Best IR Team (Telecoms)”. The Company was voted as “Best Overall Company in China — Gold” in “Asia’s Best Managed Companies Poll 2023” organised by FinanceAsia, an authoritative financial magazine. The Company was awarded “Asia’s Best CSR” by Corporate Governance Asia. The Company was accredited with “Platinum Award — Excellence in Environmental, Social, and Governance” in “The Asset ESG Corporate Awards 2023”. The Company was awarded “ESG Leading Enterprise” in “ESG Leading Enterprise 2023” by Bloomberg Businessweek and Deloitte.

Part 2 of the Corporate Governance Code as set out in Appendix C1 of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Hong Kong Stock Exchange”) (the “Listing Rules”) provides for code provisions (the “Code Provisions”) and recommended best practices with respect to (i) corporate purpose, strategy and governance, (ii) board composition and nomination, (iii) directors’ responsibilities, delegation and board proceedings, (iv) audit, internal control and risk management, (v) remuneration and (vi) shareholders engagement. Other than the disclosures made in the section headed “Board of Directors” below, the Company confirms that for the year ended 31 December 2023, it complied with all the Code Provisions.

BOARD OF DIRECTORS

To serve the best interests of the Company and its shareholders, the Board is responsible for reviewing and approving major corporate matters, including, amongst others, business strategies and budgets, major investments, capital market operations, as well as mergers and acquisitions. The Board is also responsible for monitoring risk management and internal control, reviewing environmental, social and governance strategies, reviewing and approving the announcements periodically published by the Company regarding its business results and operating activities. There is no financial, business, family or other material/relevant relationship(s) between the Board members.

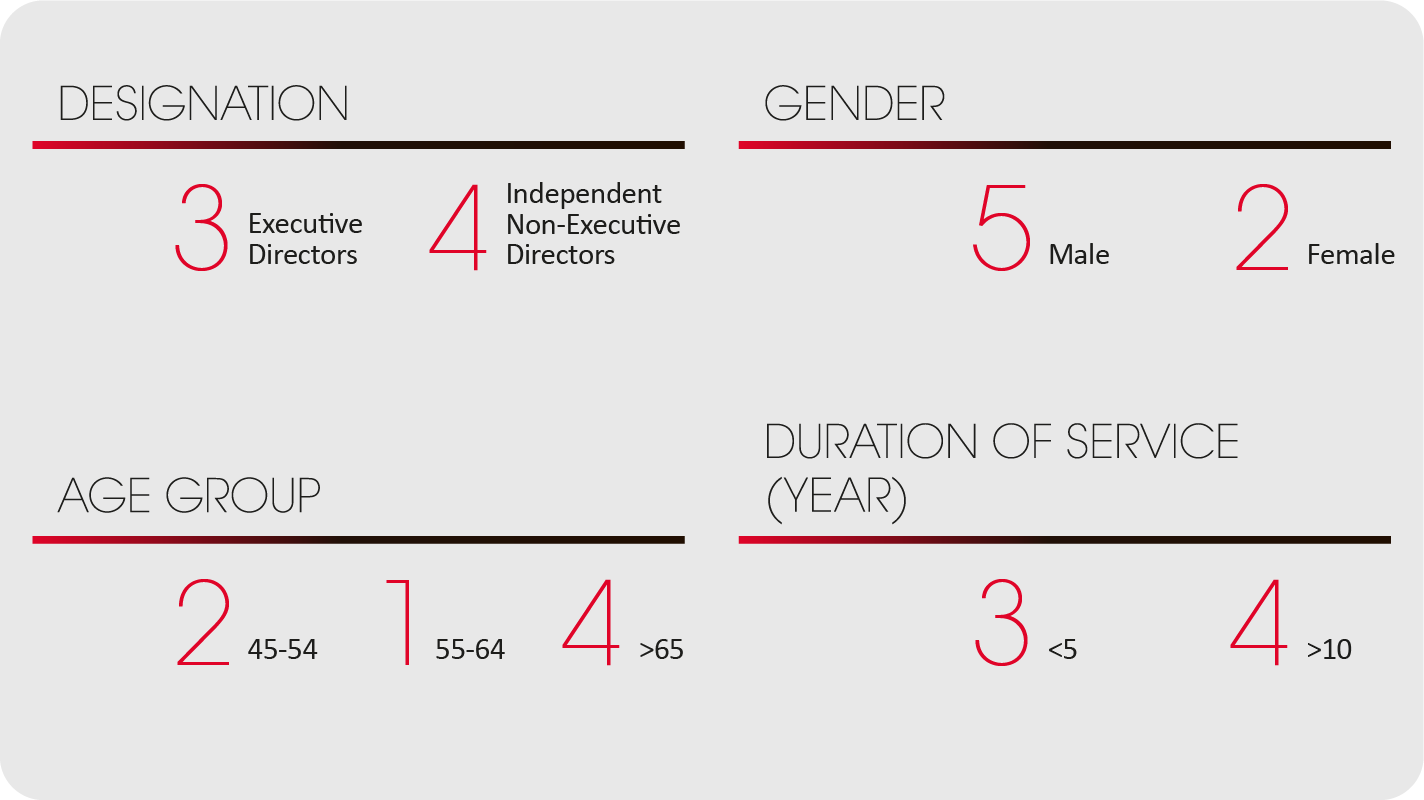

In order to achieve a sustainable and balanced development, the Company views Board diversity as a key element for supporting its strategic goals and maintaining sustainable development. The Board membership maintains wide representation. Members of the Board consist of outstanding individuals from different professions. Currently, the Board comprises seven Directors, including three executive Directors and four independent non-executive Directors. Particulars of the Directors are set out on pages 28 to 39 of this annual report. The Company believes that the Board currently comprises experts from diversified professions such as telecommunications, technology, banking, finance, investment and management, and is diversified in terms of gender, age, duration of service, educational background, professional experience, etc., which contributes to the enhanced management standard and more regulated operation of corporate governance of the Company, and results in a more comprehensive and balanced Board structure and decision-making process.

The below sets out the analysis of the current composition of the Board:

The roles and responsibilities of the Chairman and the Chief Executive Officer of the Company were performed by the same individual for the year ended 31 December 2023. The Company considers that, as all major decisions are made by the Board and relevant Board Committees after discussion, through supervision by the Board and the independent non-executive Directors together with effective internal control mechanism, the Company has achieved a balance of power and authority. In addition, the same individual performing the roles of the Chairman and the Chief Executive Officer can enhance the Company’s efficiency in decision-making and execution, effectively capturing business opportunities.

For the year ended 31 December 2023, the Company had 4 independent non-executive Directors representing over one-third of the Board with 2 independent non-executive Director possessing appropriate professional accounting or related financial management expertise as required under Rule 3.10 of the Listing Rules. All independent non-executive Directors of the Company possess good knowledge and experience in different areas. The Company has established various channels for independent non-executive Directors to express their views in an open and honest manner and, if necessary, in a confidential manner. The independent non-executive Directors have been making positive contributions to the development of the Company’s strategies and policies through independent, constructive and informed advice. Apart from the regular Board meeting, the Chairman meets annually with independent non-executive Directors, without the presence of other Directors, which further promotes the exchange of diversified views and opinions. Independent non-executive Directors have maintained close contact with the management and actively express constructive opinions on matters relating to corporate governance, operation management, risk prevention and the capital market at board meetings. These views and opinions facilitate the Board in making their decisions in the shareholders’ best interests. All independent non-executive Directors, except for their equity interests and remuneration disclosed in this annual report, do not have any business with or financial interests in the Company, its holding company or subsidiaries, and have confirmed their independence to the Company upon appointment and annually. The Company considers that all independent non-executive Directors are currently independent. Such mechanisms enable independent views and inputs are available to the Board in an effective way, and the Board will review the implementation and effectiveness of such mechanisms on an annual basis. The functions of non-executive Directors include, amongst other things, attending board meetings, exercising independent judgements at meetings, playing a leading role in resolving any potential conflicts of interest, serving on committees by invitation and carefully examining whether the performance of the Company has reached the planned corporate targets and objectives, and monitoring and reporting on matters relating to the performance of the Company. With respect to the nomination and appointment of new directors and senior management members and the succession planning for Directors, the Nomination Committee would, after considering the Company’s need for new directors and/or senior management members, identify a wide range of candidates from within the Company and the human resources market and make recommendations to the Board. The Nomination Committee will consider candidates on merit against objective criteria and with due regard to the benefits of diversity on the Board, including but not limited to gender, age, cultural and educational background, professional experience, skills, knowledge and duration of service. After having obtained the consent from candidates in relation to the relevant nomination and based on the Company’s actual needs, the Board would convene a meeting, attendees of which include non-executive Directors, to consider the qualifications of the candidates. The Directors of the Company (including non-executive Directors) are not appointed for a specific term. However, pursuant to the Company’s articles of association, one-third of the directors shall retire from office by rotation and shall be eligible for re-election at each annual general meeting.

Every newly appointed Director is provided with a comprehensive, formal and tailored induction on appointment, including but not limited to the “Guidelines on Directors’ Duties” published by the Hong Kong Companies Registry and the “Guidelines for Directors” published by the Hong Kong Institute of Directors. Directors have fiduciary responsibilities to the Company. They must not exercise their powers for improper purposes. They must not use the Company’s opportunities to serve their own interests. Their personal interests are not allowed to conflict with the Company’s interests, and they must not abuse the Company’s assets. The Director would subsequently receive all briefing and professional development necessary to ensure that he/she has proper understanding of the Company’s operations and businesses, full understanding of his/her responsibilities under the statutes, the common law, the Listing Rules, applicable legal and regulatory requirements, and the Company’s business and corporate governance policies. Furthermore, formal letters of appointment setting out the key terms and conditions of the Directors’ appointment will be duly prepared.

Directors’ training is an ongoing process. The Company regularly invites various professionals to provide trainings on the latest changes and development of the legal and regulatory requirements as well as the market and/or industrial environment to Directors. In 2023, the Directors as at 31 December 2023 have participated in various training and continuous professional development activities and the summary of which is as follows:

|

Types of training |

|

|

|

|

|

Executive Director |

|

|

Chen Zhongyue (Chairman) |

A, B |

|

Wang Junzhi |

A, B |

|

Li Yuzhuo |

A, B |

|

Independent Non-Executive Director |

|

|

Cheung Wing Lam Linus |

A, B |

|

Wong Wai Ming |

A, B |

|

Chung Shui Ming Timpson |

A, B |

|

Law Fan Chiu Fun Fanny |

A, B |

|

|

|

A: attending relevant seminars and/or conferences and/or forums; delivering speeches at relevant seminars and/or conferences and/or forums

B: reading or writing relevant newspapers, journals and articles relating to general economy, general business, telecommunications, corporate governance, business ethics or directors’ duties

The Company has determined remuneration policy. The proposed remuneration package of Directors of the Company will be determined by the Remuneration Committee, subject to approval by the Board and in compliance with applicable laws, regulations and policies, and taking into account the responsibilities of such person in the Company, his experience and performance as well as the prevailing market conditions. The remuneration package for executive Directors includes salary and performance-linked annual bonuses. The remuneration of executive Directors is determined by reference to their respective duties and responsibilities in the Company, their respective experience, prevailing market conditions and applicable regulatory requirements while the award of the performance-linked annual bonuses is tied to the attainment of key performance indicators or targets set by the Company. The remuneration of non-executive Directors is determined by reference to prevailing market conditions and their respective responsibilities and workload from serving as non-executive Directors and members of the board committees of the Company. The Company also adopted share option scheme for the purpose of providing long term incentives to eligible participants, including Directors (details of such share option scheme are set out in the paragraph headed “Share Scheme of the Company” on pages 70 to 71 of this annual report). The remuneration for each Director and the remuneration of senior management by band are disclosed on pages 144 to 146 of this annual report. In addition to the remuneration, the Company has arranged appropriate insurance coverage in respect of legal action against the Directors.

The Board has provided clear guidelines for delegation of powers and responsibilities to management. However, certain important matters must be decided only by the Board, including, but not limited to, long-term objectives and strategies, annual budget, initial announcements on quarterly, interim and final results, dividends, major investments, equity-related capital market operations, mergers and acquisitions, major connected transactions and annual internal control evaluation. The arrangements on delegation of powers and responsibilities to management are reviewed by the Board periodically to ensure that they remain appropriate to the needs of the Company.

The Board convenes meetings regularly and all Directors have adequate opportunity to be present at the meetings and to include matters for discussion in the meeting agenda. Notices of regular board meetings are delivered to the Directors at least 14 days in advance of the meetings. The Company delivers, on a best endeavor basis, all documents for regular board meetings to the Directors for review at least one week prior to the meetings (and ensures that all documents are delivered to the Directors no less than three days prior to the regular meetings as required by the Code Provisions).

The Company Secretary, being an employee of the Company, has day-to-day knowledge of the Company’s affairs and reports to the Chairman of the Board. The Company Secretary keeps close contact with all Directors and ensures that the operation of the Board and all board committees is in compliance with the procedures as set forth in the Company’s articles of association and the charters of the board committees. Additionally, the Company Secretary is responsible for compiling and regularly submitting draft minutes of board meetings and committee meetings to the Directors and committee members for their review and comments, and final versions of minutes for their records, within a reasonable time after the relevant meetings. Each Director may obtain advice from and the services of the Company Secretary to ensure that board procedures, and all applicable rules and regulations, are followed.

Physical board meetings will be held for the selection, appointment or dismissal of the Company Secretary. To ensure the possession of up-to-date knowledge and market information to perform her duties, the Company Secretary attended over 15 hours of professional training in 2023.

The Directors may, upon request, obtain independent professional advice at the expense of the Company. In addition, if any substantial shareholder of the Company or any Directors has significant conflicts of interest in a matter to be resolved, the Board will convene a board meeting in respect of such matter and those Directors who have conflicts of interest must abstain from voting and will not be counted in the quorum of the meeting.

All Directors are required to devote sufficient time and attention to the affairs of the Company. A culture of openness and debate are promoted in the Board and the Directors are encouraged to express their views and concerns. The Company provides monthly operating update to the Directors, so as to ensure the Directors are familiar with the Company’s latest operations. In addition, through regular board meetings and reports from management, the Directors are able to clearly understand the operations, business strategy and latest development of the Company and the industry. Besides formal board meetings, the Chairman also meets annually with independent non-executive Directors, without the presence of other Directors, which further promotes the exchange of diversified views and opinions. In order to ensure that all Directors have appropriate knowledge of the matters discussed at the meetings, adequate, accurate, clear, complete and reliable information regarding those matters is provided in advance and in a timely manner, and all Directors have the right to inspect documents and information in relation to matters to be decided by the Board. The Directors have frequently visited various branches in Mainland China to gain better understanding of the Company’s daily operations. In addition, the Company has arranged relevant trainings for the Directors (which include training sessions conducted by professional advisers, such as lawyers and accountants, from time to time) in order to broaden their knowledge in the relevant areas and to improve their understanding of the Company’s business, legal and regulatory requirements and the latest operational technologies. The Board also conducts annual evaluation of its performance. Such efforts have improved the corporate governance of the Company.

In 2023, the Board held four board meetings and passed one written resolution for, amongst other things, discussion and approval of important matters such as the 2022 annual results, the 2023 annual budget, the 2023 interim results, the first and the first three quarters results for 2023, sustainability report, reports on risk management and internal control, amendment of the articles of association, and the amendment of the remuneration committee charter, appointment of chairman and chief executive officer, appointment of senior vice president.

Set forth below is an overview of the attendance during the year of 2023 by the Board members at various meetings:

|

Meetings Attended/Held During Each Director’s Tenure |

|||||

|

|

|||||

|

Board |

Audit |

Remuneration |

Nomination |

Shareholders |

|

|

|

|

|

|

|

|

|

Executive Directors |

|||||

|

Chen Zhongyue (Chairman)1 |

4/4 |

N/A |

N/A |

N/A |

0/1 |

|

Liu Liehong2 |

2/2 |

N/A |

N/A |

1/1 |

1/1 |

|

Wang Junzhi |

3/4 |

N/A |

N/A |

N/A |

0/1 |

|

Li Yuzhuo |

3/4 |

N/A |

N/A |

N/A |

1/1 |

|

Independent Non-Executive Directors |

|||||

|

Cheung Wing Lam Linus |

4/4 |

4/4 |

1/1 |

N/A |

1/1 |

|

Wong Wai Ming |

3/4 |

3/4 |

0/1 |

N/A |

1/1 |

|

Chung Shui Ming Timpson |

4/4 |

4/4 |

1/1 |

1/1 |

1/1 |

|

Law Fan Chiu Fun Fanny |

4/4 |

4/4 |

N/A |

1/1 |

1/1 |

|

|

|

|

|

|

|

Note 1: On 2 December 2023, Mr. Chen Zhongyue was appointed as the Chairman and Chief Executive Officer of the Company and has ceased to serve concurrently as the President of the Company.

Note 2: On 30 July 2023, Mr. Liu Liehong resigned as executive Director of the Company and ceased to serve as the Chairman and Chief Executive Director of the Company.

Note 3: Certain Directors (including non-executive Director) did not attend the shareholders meeting and meetings of the Board and Committees due to other business commitments or being overseas.

In 2023, the Board performed their fiduciary duties and devoted sufficient time and attention to the affairs of the Company. The Board works effectively and performs its responsibilities efficiently with all key and appropriate issues being discussed and approved in a timely manner.

The Company has adopted the “Model Code for Securities Transactions by Directors of Listed Issuers” as set out in Appendix C3 to the Listing Rules (the “Model Code”) to govern securities transactions by directors. Further to the specific enquiries made by the Company to the Directors, all Directors have confirmed their compliance with the Model Code for the year ended 31 December 2023.

The Directors acknowledge their responsibilities for preparing the financial statements for the year ended 31 December 2023, which give a true and fair view of the financial position of the Company as at the statement of financial position date and financial performance and cash flows of the Company for the year ended the statement of financial position date, are properly prepared on the going concern basis in accordance with relevant statutory requirements and applicable financial reporting standards. A statement of the independent auditors about their reporting responsibilities related to the financial statements is set out in the independent auditor’s report on pages 88 to 92 of this annual report.

COMMITTEES UNDER THE BOARD

The Company has established three committees of the Board under the Board, the Audit Committee, the Remuneration Committee and the Nomination Committee. Each committee has a written charter, which is available on the websites of the Company and The Stock Exchange of Hong Kong Limited. From time to time as required by the Listing Rules, the Board also establishes independent board committee for the purpose of advising and providing voting recommendations to independent shareholders on connected transactions and transactions subject to independent shareholders’ approval entered into by the Company and/or its subsidiaries. The committees are provided with sufficient resources, including, amongst others, obtaining independent professional advice at the expense of the Company, to perform their duties. The committees report their decisions or recommendations to the Board after meetings.

Audit Committee Composition

Currently the Audit Committee comprised Mr. Wong Wai Ming, Mr. Cheung Wing Lam Linus, Mr. Chung Shui Ming Timpson and Mrs. Law Fan Chiu Fun Fanny, all being independent non-executive Directors of the Company. The Chairman of the Audit Committee is Mr. Wong Wai Ming. All members of the Audit Committee have satisfied the “independence” requirements in relation to an Audit Committee member under applicable laws, regulations and rules. The Chairman of the Audit Committee is an accountant with expertise and experience in accounting and financial management. Another member of the Audit Committee is also an accountant with extensive accounting professional experience.

Major Responsibilities

The primary responsibilities of the Audit Committee include: as the key representative body, overseeing the Company’s relationship with the independent auditor, considering and approving the appointment, resignation and removal of the independent auditor; pre- approval of services and fees to be provided by the independent auditor based on the established pre-approval framework; supervising the independent auditor and determining the potential impact of non-audit services on such auditor’s independence; reviewing quarterly and interim financial information as well as annual financial statements; coordinating and discussing with the independent auditor with respect to any issues identified and recommendations made during the audits; reviewing correspondences from the independent auditor to the management and responses of the management; discussing the risk management and internal control system with the management as well as reviewing the reports on the risk management and internal control procedures of the Company. The Audit Committee set up a whistle-blowing system to receive and handle cases of complaints regarding the Company’s financial reporting, internal control or other matters. The whistle-blowers can use, in confidence and anonymity, to raise concerns about possible improprieties in any matter related to the Company through whistle- blowing channels. Any complaints on the aforementioned subject matters can be submitted by post (No. 21 Financial Street, Xicheng District, Beijing, 100033, China) or by phone (86-(010) 88091674). The Audit Committee is responsible to and regularly reports its work to the Board.

Work Completed in 2023

The Audit Committee meets the Board and management as well as independent auditor at least four times each year, and assists the Board in its review of the financial statements to ensure effective risk management and internal control as well as efficient audit. Besides, the Audit Committee meets the independent auditor at least two times each year, without the presence of other Directors and management.

The Audit Committee held four meetings in 2023 for, amongst other things, discussion and approval of the 2022 annual results, the 2023 interim results, and the first and the first three quarters results for 2023. In addition, the Audit Committee approved in the meetings the sustainability report, the report of the work of sustainability, the report on risk management, the report on internal audit and internal control, the report on continuing connected transaction, the appointment, the audit fees and the audit plans of the independent auditor as well as the non-audit services provided by the independent auditor in 2023.

The Audit Committee has performed its duties effectively, and enabled the Board to better monitor the financial condition of the Company, supervise the risk management and internal control (included but not limited to operational, financial, compliance, environmental, social and governance) of the Company, ensure the integrity and reliability of the financial statements of the Company, prevent significant errors in the financial statements and ensure the Company’s compliance with the relevant requirements of the Listing Rules with respect to audit committee.

Remuneration Committee Composition

Currently the Remuneration Committee comprised Mr. Cheung Wing Lam Linus, Mr. Wong Wai Ming and Mr. Chung Shui Ming Timpson, all being independent non-executive Directors of the Company. The Chairman of the Remuneration Committee is Mr. Cheung Wing Lam Linus.

Major Responsibilities

The primary responsibilities of the Remuneration Committee include: making recommendations to the Board on the policies and structure for all Directors’ and senior management’s remuneration and on the establishment of a formal and transparent procedure for developing remuneration policy; reviewing and approving the management’s remuneration proposals with reference to the corporate goals and objectives set by the Board; making recommendations to the Board on the remuneration packages of individual executive Directors and senior management (including benefits in kind, pension right and compensation payments, including any compensation payable for loss or termination of their office or appointment); making recommendations to the Board on the remuneration of non-executive Directors; consulting the Chairman about the remuneration proposals for other executive Directors; considering salaries paid by comparable companies, time commitment and responsibilities and employment conditions elsewhere in the Group; considering any concrete plan proposed by the management of the Company for the grant of share which has not been granted, and any plan to amend any existing share scheme of the Company; reviewing and approving compensation payable to executive Directors and senior management for any loss or termination of office or appointment to ensure that it is consistent with contractual terms; reviewing and approving compensation arrangements relating to dismissal or removal of Directors for misconduct to ensure that they are consistent with contractual terms; and ensuring that no Director or any of his/her associates is involved in deciding his/her own remuneration.

Work Completed in 2023

The Remuneration Committee meets at least once a year. The Remuneration Committee held one meeting in 2023 for, amongst other things, discussion and approval of proposal for appraisal and remuneration of senior management, the amendment of remuneration committee charter.

The Remuneration Committee has performed its duties effectively on reviewing and approving the proposal of appraisal of senior management, as well as making recommendations to the Board with regards to the remuneration packages for senior management.

Nomination Committee Composition

Currently the Nomination Committee comprised Mr. Chung Shui Ming Timpson, Mr. Chen Zhongyue and Mrs. Law Fan Chiu Fun Fanny. Except for Mr. Chen Zhongyue, who is the Chairman and CEO of the Company, Mr. Chung Shui Ming Timpson and Mrs. Law Fan Chiu Fun Fanny are independent non-executive Directors of the Company. The Chairman of the Nomination Committee is Mr. Chung Shui Ming Timpson.

Major Responsibilities

The primary responsibilities of the Nomination Committee include: reviewing the structure, size and composition (including the skills, knowledge and experience) of the Board at least annually and making recommendations on any proposed changes to the Board to complement the corporate strategy of the Company; identifying individuals suitably qualified to become Board members and making recommendations to the Board; formulating, reviewing and implementing the board diversity policy; assessing the independence of independent non-executive Directors; making recommendations to the Board on the appointment or re- appointment of Directors and succession planning for Directors; providing advice to the Board on candidates of the senior management nominated by the CEO and on changes to the senior management of the Company.

Work Completed in 2023

The Nomination Committee meets at least once a year. The Nomination Committee held one meeting and passed one written resolutions in 2023 for, amongst other things, reviewing the structure, size and composition of the Board, reviewing the board diversity policy and its implementation, assessment of the independence of independent non-executive Directors, making recommendations to the Board on the proposed re-election of Directors and the appointment of executive Directors.

The Company has determined nomination policy. With respect to the nomination and appointment of new directors and senior management members and the succession planning for directors, the Nomination Committee would, after considering the Company’s need for new directors and/or senior management members, identify a wide range of candidates from within the Company and the human resources market and make recommendations to the Board. The Nomination Committee will consider candidates on merit against objective criteria and with due regard to the benefits of diversity on the Board, including but not limited to gender, age, cultural and educational background, professional experience, skills, knowledge and duration of service. After having obtained the consent from candidates in relation to the relevant nomination and based on the Company’s actual needs, the Board would convene a meeting, attendees of which include non-executive Directors, to consider the qualifications of the candidates. Pursuant to the Company’s articles of association, one-third of the Directors shall retire from office by rotation and be eligible for re- election at each annual general meeting.

The Company has also determined a policy concerning diversity of board members. The Company recognises and embraces the benefits of having a diverse Board, and notes increasing diversity at Board level as an essential element in maintaining a competitive advantage. All Board appointments are made on merit on a selective basis, in the context of the skills and experience the Board as a whole requires to be effective. In reviewing Board composition, the Nomination Committee will consider their professional knowledge, skills, experience and the balance of diversity of perspectives which are appropriate to the Company’s business model and specific needs. In identifying suitable candidates for appointment to the Board, the Nomination Committee will give due regard to the benefits of diversity on the Board and base on a range of diversity perspectives including but not limited to gender, age, cultural and educational background, professional experience, skills, knowledge and duration of service. The ultimate decision will be based on merit and contribution that the selected candidates will bring to the Board. The Board and the Nomination Committee review the board diversity policy as well as its implementation and effectiveness every year to ensure that the board diversity policy continues to serve its purpose. Currently the Board comprises seven members, amongst which two members, accounting for 29% of the whole Board, are female directors. The Board considers that gender diversity is achieved in respect of the Board, and targets to maintain at least the current level of female representation. In addition, the gender proportion (Male/Female) of all employees of the Company is 1.62:1. The female representation in senior management has continuously increased, from 11.9% in 2019 to 12.3% in 2023. The Company targets to maintain at least the current level of female representation in the workforce (including senior management). The Company is not aware of any mitigating factors or circumstances which make achieving gender diversity across the workforce (including senior management) more challenging or less relevant. The Company strictly implemented the relevant provisions of the Labour Contract Law, adopted strict inspection and control procedures in recruitment and promotion and strictly prohibited any discrimination against employees in terms of age and gender. The Company also ensures that the recruitment and selection practices at all levels are appropriately structured so that a diverse range of candidates are considered. The Company cares about female employees. It protected the rights and interests of female employees and provided targeted and considerate services to them, to retain the female talents.

In addition, pursuant to the Company’s articles of association, shareholder may propose other person for election as a director at general meeting. The proposal will be considered and approved in the general meeting. With regard to the procedure for shareholder to propose a person for election as a director, please visit the Company’s website at https://www.chinaunicom.com.hk/en/esg/cg_report.php.

INDEPENDENT AUDITOR

Deloitte Touche Tohmatsu is the independent auditor of the Company. Apart from audit services, it also provides other assurance and non-audit services. The audit committees supervised the independent auditor and determined the potential impact of non-audit services on such auditor’s independence, and pre-approved the services and fees to be provided by the independent auditor based on the established pre-approval framework. The remuneration paid/payable to the independent auditor for provision of services in 2023 is as follows:

|

2023 |

||

|

Items |

Note |

(in RMB thousands) |

|

|

|

|

|

Audit services for financial statements |

(i) |

44,480 |

|

Other special purpose audit and assurance services |

(ii) |

10,714 |

|

Non-audit services |

(iii) |

15,533 |

|

|

|

|

Notes:

(i) Audit services for financial statements in 2023 mainly included the provision of audit service for the Company’s consolidated financial statements, and statutory audit services for the financial statements of its subsidiaries.

(ii) Other special purpose audit and assurance services are the audit and assurance services other than the audit services for financial statements.

(iii) Non-audit services included other services that can be reasonably provided by the independent auditor. In 2023, the provisions of non-audit services mainly included tax compliance services and other advisory services.

RISK MANAGEMENT AND INTERNAL CONTROL

The Board is responsible for evaluating and determining the nature and extent of the risks it is willing to take in achieving the Company’s strategic objectives, and ensuring that the Company establishes and maintains appropriate and effective risk management and internal control systems (included but not limited to operational, financial, compliance, environmental, social and governance), promotes the sustainable and healthy development of the Company, and enhances the Company’s operation management level and risk prevention ability. The Board should oversee management in the design, implementation and monitoring of the risk management and internal control systems, and management should provide a confirmation to the Board on the effectiveness of these systems. The Board acknowledges that it is its responsibility for the risk management and internal control systems and reviewing their effectiveness.

Risk management and internal control systems have been designed to monitor and facilitate the accomplishment of the Company’s business objectives, safeguard the Company’s assets against loss and misappropriation, ensure maintenance of proper accounting records for the provision of reliable financial information, ensure the Company’s compliance with applicable laws, rules and regulations. Such systems are designed to manage rather than eliminate the risk of failure to achieve business objectives, and can only provide reasonable and not absolute assurance against material misstatement or loss.

Organisation systems

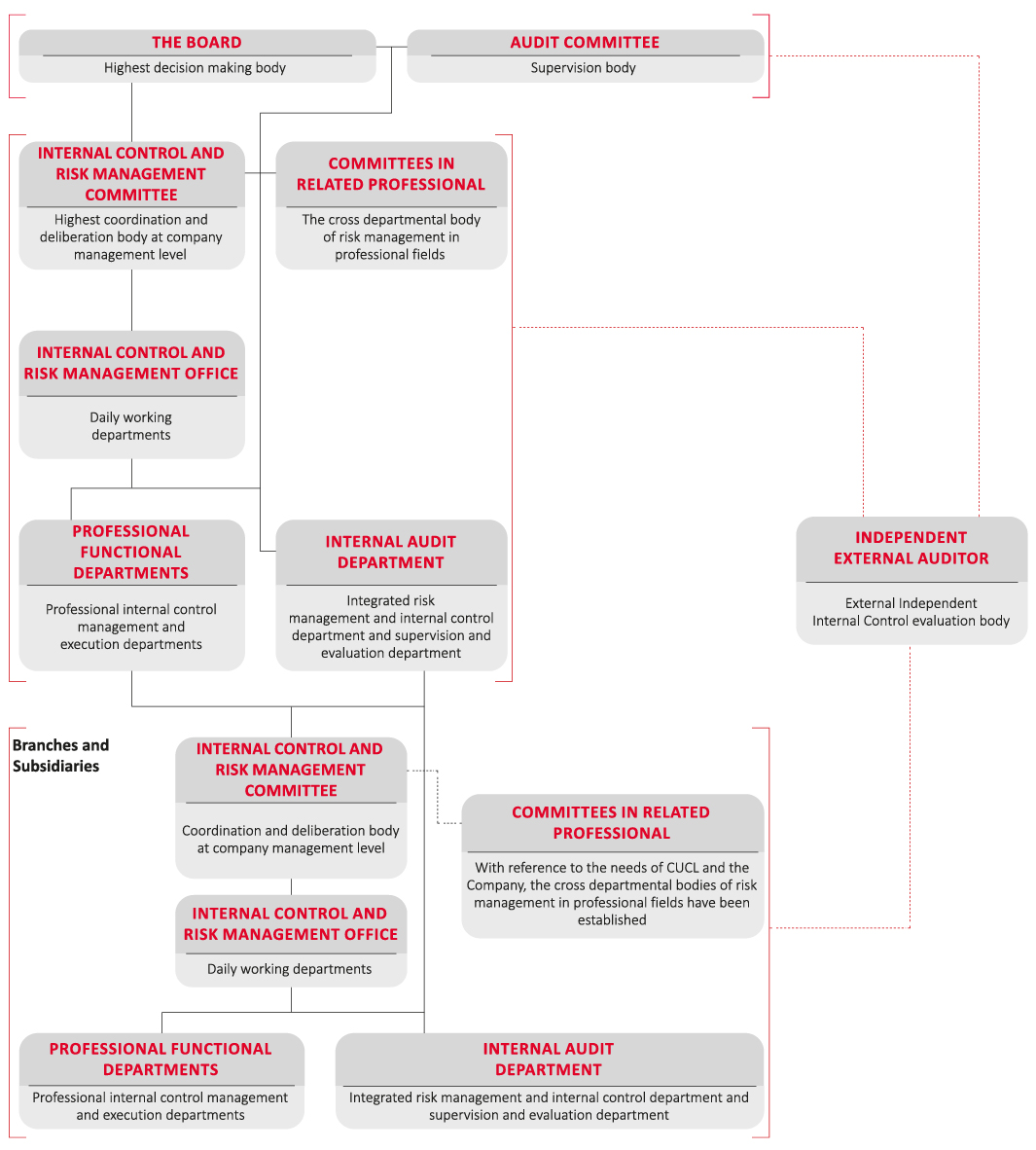

The Company set up a group-wide risk management and internal control systems consisting of the Board, the Internal Control and Risk Management Committee, the Integrated Management Department and each relevant professional functional departments.

The Company has an internal audit department with 652 staff members, with officers stationed at various provincial branches. The internal audit department reports directly to the Audit Committee at least twice annually and is independent of the Company’s daily operation and accounting functions. The internal audit department is responsible for overall risk evaluation, special risk evaluation and internal control self-testing etc. It has also formulated targeted risk prevention and control measures, conducted risk follow-up inspections and has enhanced the risk awareness of the employees, all of which have played an active role in the Company’s effective support and safeguard of its operation management and business development. Furthermore, with an emphasis on the effectiveness of internal control with respect to the efficiency of operations, accuracy of financial information, and compliance with rules and regulations, the internal audit department conducts, amongst others, internal control assessment and internal audit on economic accountability. In addition, the internal audit department also contributes to strengthening the operation and management, improving internal control systems, mitigating operational risks and increasing the economic efficiency of the Company.

Using the risk evaluation as fundamental with the adoption of Internal Control Integrated Framework issued by the Committee of Sponsoring Organisations of the Treadway Commission (the “COSO”), the Company established and improved internal control systems based on the following five fundamental components:

1. Control Environment: Establishes the control environment which fulfill COSO requirements to provide the appropriate operating environment for the effective implementation of internal control

2. Risk Evaluation: Establishes the Policy on Risk Evaluation Management and evaluation mechanism, evaluates the risks to the achievement of its objectives across the Company and identifies to the new risk due to the changes

3. Control Activities: Deploys appropriate policies and control procedures over the Company’s business activities, identifies key control procedures and policies of significant control activities through evaluation

4. Information and Communication: Identifies relevant information and communication methods, establishes information and communication mechanisms to aggregate and delivers relevant information

5. Monitoring Activities: Establishes the internal control monitoring mechanism, implements the monitoring procedures and adopted the before, during and extensive monitoring principles, and carries on the proper monitoring to the internal control

Risk evaluation and management

The Company has established and gradually improved its comprehensive closed-loop risk management system for the purpose of “integrating management of day-to-day general risks and spontaneous critical risks”, achieved the closed-loop management by risk evaluation, early warning and follow-up inspections to ensure the effectiveness of operation management. The Company evaluated the adequacy and appropriateness on risk and control measures according to the new business model, management requirement, change of system, adjustment of duties and findings from internal and external inspections.

2023 Risk evaluation result

The followings were the major significant risks which the Company encountered and its countermeasures in 2023:

Network and cybersecurity risk

Cybersecurity is an important component of national security. Cybersecurity and informatisation complement each other, in the sense that security is the premise of development and development is the guarantee of security. The Company attaches great importance to network and cybersecurity, strictly complies with the requirements of national laws and regulations, and insists on serving the construction of Cyber Superpower and Digital China. We take the maintenance of network and cybersecurity as an important mission of responsibility, and are committed to serving as the leading contributor of digital information operation and services and the pioneer of digital technology integration and innovation.

Public opinion risk

With the rapid development of self-media in recent years, the internet has not only increased the speed of information dissemination, but also made information development more diversified and fragmented. Properly managing public opinions is an important task for the Company’s reform, development, production and operation. The Company conscientiously fulfills the mission and tasks of a central state-owned enterprise that driven by the demand of Company’s high-quality development in managing the Company’s news and public opinions continuously. It actively expands media cooperation relations and guides positive public opinions and information, which enhances the expectations and confidence of all parties for the Company’s high-quality development in the capital market.

Risk of high-quality development of computing and digital smart applications business

With the vigorous development of the digital economy, new technologies, new business forms and new models continue to emerge, and the profound transformation brought by the deep integration of the digital and real economies provides a broad space for the Company’s innovation and transformation, improvement of core competitiveness and sustainable development. The Company attaches great importance to the R&D of innovative products, strengthens the position of enterprises as the main body of scientific and technological innovation, and increases the layout of strategic emerging industries. It plays the role of scientific and technological innovation, industrial control and security support, and lead the industrial transformation and upgrading through technological innovation.

Risk of fixed asset investment

Characterised by large investment scale, wide expertise and long project management chain, the fixed asset investment of telecom operators effectively controls the investment direction, meets the business needs of the market, and puts forward higher requirements for improving construction efficiency and investment efficacy. The Company attaches great importance to fixed asset investment, deepens its implementation of the new digital infrastructure plan, insists on strengthening and solidifying. We reasonably control the investment scale for the purpose of accurate construction, efficient operation and improvement of investment efficacy, thus driving the Company towards high-quality development.

The scope of the 2023 overall risk evaluation covered the whole Group, which included headquarter, 31 provincial companies and its cities-level branch offices and subsidiaries. Through both the quantitative and qualitative analysis, the Company fully considered the changes in operating environment, business and policies, identified the potential risk to the Company’s operation, and planned for the risk according to the quantitative result. After reporting to each professional departments and the management, the significant risks and the risk level of the year were finally determined. The annual risk management instructions from the management were implemented according to the Policy on Risk Management and the Company’s risk management requirement. This included the formulation of relevant risk management strategies, solution and corresponding departments carried out interim follow-up inspection works. The negative impacts arising from the risks and risk events were controlled as planned and were within an acceptable range. There were no significant control failings or weaknesses that have been identified during the year.

Monitoring and Optimisation

To ensure the effectiveness of risk management and internal control designs, the Company carried out risk evaluation timely and compared the risk points, formulated or enhanced corresponding internal control measures according to the change in business and management. At the same time, the internal control manual will be updated timely through the assessment and review on applications on internal control workflow modification submitted by professional departments, risk evaluation reports and exceptional issues from internal control assessment etc., so as to provide the effective support for the development of the sustainable growth of the Company. Internal Control and Risk Management Office conducted inspections on effectiveness on risk management and internal control implementation in regular or irregular time interval, improved and enhanced risk management and internal control designs continuously. Our Internal Audit Department has continued to organise our branches and subsidiaries to conduct annual internal control self-assessment based on the actual conditions of each unit and improve the quality of such self- assessment tasks, so as to gradually develop a quantitative internal assessment regime governed by uniform standards. Through the effective rectification of issues identified during the audit, assessment of the internal control system and its implementation, improvements made to the system and process optimisation, a long-term mechanism for closed-loop management in internal control has been put in place. According to the internal control self-assessment reports from the branches and subsidiaries, self- assessment reports from each professional department, current year exceptional issues in internal control discovered during internal audit and the Company annual risk management report, the Group’s Internal Control and Risk Management Office at its headquarter formed the Company’s internal control self-assessment report, which acted as supporting document for the management to issue a statement of the effectiveness of internal control. Based on different disclosure requirements on Company’s internal control assessment report from different listing regulatory body, the Company prepared internal control assessment report respectively.

As a telecommunications operator, the Company is subject to the laws and regulations, e.g., relevant provisions in the Cybersecurity Law of the People’s Republic of China, Data Security Law of the People’s Republic of China, Personal Information Protection Law of the People’s Republic of China and Anti-Telecom and Online Fraud Law of the People’s Republic of China, designed to protect critical information infrastructure. Personal privacy, information security, and data protection are increasingly significant issues in China and other jurisdictions in which the Company operate. For example, Cybersecurity Law of the People’s Republic of China published in 2016 which sets forth the general framework regulating network products, equipment and services, as well as the operation and maintenance of information networks, the protection of personal data, and the supervision and administration of cybersecurity in China. The Data Security Law of the People’s Republic of China and Personal Information Protection Law of the People’s Republic of China published in 2021 further regulate data and personal information processing activities, and protect the legitimate rights and interests of individuals and organisations from being infringed. The Anti-Telecom and Online Fraud Law of the People’s Republic of China published in 2022 which clearly stated that telecommunications, finance, and network institutions are the main anti-fraud entities, and carry out targeted system design for various aspects of telecom and online fraud to consolidate corporate responsibility. The Company also devotes significant resources to network security, data security and other security measures to protect its systems and data and in response to the evolving cybersecurity laws and regulations. The Company also employs risk management and internal control systems. including, among other things, (i) continuously strengthening data security capabilities, such as improving data encryption, protection of critical information infrastructure and security of supply chain of the information technology products and services; (ii) establishing data protection compliance policies and guidelines, including training on crisis management and compliance of cybersecurity laws and regulations; (iv) self-examining potential risks and weakness of data system and updating private policy; (iv) enhancing the real-time monitoring and alarm reporting system and implementing an emergency action plan to allow the Company to act responsively and minimise losses in the event of an emergency; and (v) continuously improving compliance efforts through enhanced sharing of relevant knowledge internally and externally. The Company is required to perform a security assessment when transferring personal information and important data overseas if such personal information and important data are collected and generated from the operation in China.

Annual review

The Board oversees the Company’s risk management and internal control systems on an ongoing basis and the Board conducted an annual review of the risk management and internal control systems of the Company and its subsidiaries for the financial year ended 31 December 2023, which covered all material controls including financial, operational and compliance controls. After receiving the reports from the Internal Audit Department, as well as the confirmation from the management to the Board on the effectiveness of these systems, the Board is of the view that the Company’s risk management and internal control systems is effective and adequate. The review also ensure the adequacy of resources, staff qualifications and experience, training programmes and budget of the Company’s accounting, internal audit, financial reporting function, as well as those relating to the Company’s ESG performance and reporting.

Information Disclosure Controls and Procedural Standards

In order to further enhance the Company’s system of information disclosure, and to ensure the truthfulness, accuracy, completeness and timeliness of its public disclosures (including inside information), the Company has adopted and implemented the Information Disclosure Control Policy. In an effort to standardise the principles for information disclosures, the Company established the Information Disclosure Review Committee under the management and formulated the procedures in connection with the compilation and reporting of the Company’s financial and operational statistics and other information, as well as the procedures in connection with the preparation and review of the periodic reports. Moreover, the Company established detailed implementation rules with respect to the contents and requirements of financial data verification, in particular, the upward undertakings by the individual responsible officers at the major departments.

Policy and Work of Anti-corruption

China Unicom always adheres to the principles of “rigorous tone, rigorous measures and rigorous environment”, promotes the idea of “deter, disable and discourage”, promote anti-corruption and anti-privileged, further consolidating and expanding the results of anti-corruption.

Strengthening the anti-corruption system

In 2023, the Company continued to strengthen the system and mechanism. We enhanced publicity and enforcement efforts to resolutely curb and prevent corruption.

Standardising the acceptance of letters and visits: the Company issued the Opinions on Several Issues Concerning the Application of the Regulations on Letters and Visits by China Unicom Disciplinary Inspection and Supervision Institutions to promote the accurate understanding of core principles and requirements, foster the establishment of a good reporting order in the form of letters and visits, and continuously improve the standardisation level of work.

Improving the punishment mechanism: the Company further regulated the rules and regulations for disciplinary actions against suspected target of illegal crime monitoring. It strengthened the bridging mechanism for handling corruption cases, and intensified the seriousness, standardness and timeliness of disciplinary actions.

Enhancing the anti-corruption efficacy: the Company issued the Guiding Opinions on Further Strengthening and Standardising the Quality Review of Cases, clarified the evaluation standards, and promoted the fight against corruption through the application of the rule of law thinking and approach.

Strengthening anti-corruption mechanisms

Strengthen risk prevention and control: China Unicom continued to improve the integrity risk prevention and control system, identify integrity risk points, and enhance preventive and control measures.

Strengthening supervision and restriction: China Unicom delved into the application of an all-dimensional supervision system and strengthened daily supervision around key personnel, matters and areas. The Company detected any signs of irregularities at the earliest to nip the buds. It explored the use of digital means to carry out online real-time supervision and took the initiative to prevent risks in advance.

Deepening warning education: China Unicom produced special documentaries on warning education, reported and exposed corrupt cases, attended court hearings as observers in relevant cases and carried out special warning education on typical cases, so as to educate and guide cadres and employees to be law-abiding, maintain vigilance, and uphold the bottom line.

Deepening the construction of integrity culture in the new era: The Company issued China Unicom’s Core Concepts of Integrity Culture and Integrity Code of Conduct as a means to promote the integrity culture into the teams, departments, frontline units, positions, families and partners.

In 2023, China Unicom provided anti-corruption education and training to a total of 2.593 million person-time and achieved 100% employee coverage in anti-corruption education activities.

POLICY ON PAYMENT OF DIVIDEND

The Company is committed to sharing the fruits of its long-term development with shareholders while continuing to promote good growth of revenue and profit and maintaining its sustainable development capability. The declaration and payment of future dividends will depend upon, among other things, financial condition, business prospects, future earnings, cash flow, liquidity level and cost of capital. The Company believes such policy will provide the shareholders with a stable return in the long term along with the growth of the Company. Pursuant to the Companies Ordinance (Chapter 622 of the Laws of Hong Kong) and the Company’s articles of association, the Company may only pay dividends out of profits available for distribution.

Taking into consideration the Company’s robust business development, the Board recommended the payment of a final dividend of RMB0.1336 per share for the year ended 31 December 2023, together with an interim dividend of RMB0.203 per share already paid during the year, total dividend for 2023 amounted to RMB0.3366 per share.

CORPORATE TRANSPARENCY AND INVESTOR RELATIONS

In addition to publishing annual reports and interim reports, the Company discloses major unaudited financial information (including revenue, operating expenses, EBITDA, net profit) and other key performance indicators on a quarterly basis and announces key operational statistics on a monthly basis in order to enhance the Company’s transparency and improve investors’ understanding of the business operations of the Company.

Upon the announcement of interim and annual results or major transactions, the Company will generally hold analyst briefings, press conferences, and global conference with investors. During such conferences, the management of the Company would interact directly with analysts, fund managers, investors and journalists to provide them with relevant information and data of the Company. The Company’s management would accurately and thoroughly respond to questions raised by analysts, fund managers, investors and journalists. Archived webcast of the investor presentation is also available on the Company’s website to ensure wide dissemination of information and data.

The Company’s investor relations department is responsible for providing information and services requested by investors, maintaining timely communications with investors and fund managers, including responding to investors’ inquiries and meeting with company-visit investors, as well as gathering market information and passing views from shareholders to the Directors and management to ensure such views are properly communicated. The Company also arranges from time to time road shows and actively attends investor conferences arranged by investment banks, through which the Company’s management meets and communicates with investors to provide them with opportunities to understand more accurately the Company’s latest development and performance in various aspects, including business operations and management.

In 2023, the Company participated in the following investor conferences:

|

Date |

Conferences |

|

|

|

|

January 2023 |

Credit Suisse 9th Greater China Technology and Internet Conference |

|

January 2023 |

UBS Greater China Conference 2023 |

|

March 2023 |

26th Credit Suisse Asian Investment Conference |

|

May 2023 |

Macquarie DELTAH China Conference 2023 |

|

June 2023 |

UBS Future-Now APAC Conference 2023 |

|

September 2023 |

4th Annual Jefferies Asia Forum |

|

September 2023 |

30th CITIC CLSA Flagship Investors’ Forum |

|

November 2023 |

Daiwa Investment Conference Hong Kong 2023 |

|

|

|

In addition, through announcements, press releases and the Company website (www.chinaunicom.com.hk), the Company disseminates the latest information regarding any significant business development in a timely and accurate manner. In the perspective of investor relations, the Company’s website not only serves as an important channel for the Company to disseminate press releases and corporate information to investors and the capital market, but also plays a significant role in the Company’s valuation and our compliance with regulatory requirements for information disclosure. In 2023, the Company updated the content of its website on an ongoing basis to further enhance the functions of website and level of transparency in information disclosure, striving for achieving international best practices. Our website was honored with the Grand Award by an international institution, “iNova Awards”, this year.

Furthermore, the Company has determined a Shareholders’ Communication Policy which has been uploaded on the Company’s website, so as to ensure that the shareholders of the Company are provided with readily, equal and timely access to balanced and understandable information about the Company, to enable shareholders to exercise their rights in an informed manner, and to enhance the shareholders’ and the investment community’s communication with the Company. The Company maintains as on- going dialogue with shareholders while gathering market information and passing views from shareholders to the Directors and management, through the different channels as set out in the Shareholders’ Communication Policy, including but not limited to corporate communications, company’s website, general meetings and investor conferences. The Board reviewed the Company’s shareholders and investor engagement and communication activities conducted during the year and was satisfied with the implementation and effectiveness of the Shareholders’ Communication Policy.

The Company’s effort in investor relations is well recognised by the capital market, and accredited with a number of awards. The Company was voted as “Asia’s Best IR Team (Telecoms)” in “2023 All-Asia Executive Team” ranking organised by Institutional Investor.

SHAREHOLDERS’ RIGHTS

Annual General Meeting

The Board endeavors to maintain an on-going dialogue with shareholders, and in particular, to communicate with shareholders through annual general meetings. Notices of annual general meeting are sent to shareholders at least 21 days before the meeting. The Directors and representatives of the Board committees usually attend the meetings and treasure the opportunities to communicate with shareholders at such meetings. The independent auditor also attends the annual general meeting for the reporting to shareholders every year. At general meetings, the chairman of the meeting proposes individual resolutions in respect of each substantially separate matter. All matters at the Company’s general meetings are resolved by poll and the relevant procedures are explained at the meeting. The Company also appoints external scrutineers to ensure that all votes are counted and recorded appropriately, and publishes the poll results in a timely manner.

The last annual general meeting of the Company was held on 19 May 2023, at which the following resolutions were passed and percentage of votes cast in favor of the resolutions are set out as follows:

• to receive and consider the financial statements and the Reports of the Directors and of the Independent Auditor for the year ended 31 December 2022 (over 99%)

• to declare a final dividend for the year ended 31 December 2022 (over 99%)

• to re-elect Mr. Chen Zhongyue, Mr. Wong Wai Ming and Mr. Chung Shui Ming Timpson as Directors, and to authorise the Board to fix remuneration of the Directors (over 97%)

• to re-appoint auditor and authorise the Board to fix their remuneration for the year ending 31 December 2023 (over 99%)

• to grant a general mandate for share buy-back (over 99%)

• to grant a general mandate to issue new shares (over 96%)

• to extend the general mandate to issue new shares (over 96%)

• to approve the proposed amendments to the Articles of Association of the Company and the adoption of the new Articles of Association of the Company (over 99%)

The next annual general meeting will be held on 30 May 2024. Please refer to the circular, which sets out the details, that has been dispatched together with this Annual Report.

Putting Forward Resolutions at Annual General Meetings

Pursuant to Section 615 of the Companies Ordinance (Chapter 622 of the Laws of Hong Kong), the following persons may put forward a resolution at the next annual general meeting of the Company: (a) any number of shareholders, together holding not less than 2.5% of the total voting rights of all shareholders which have, as at the date of the requisition, a right to vote at the next annual general meeting, or (b) not less than 50 shareholders who have a right to vote on the resolution at the annual general meeting to which the requests relate.

The resolution must be one which may be properly moved and is intended to be moved at the next annual general meeting. The requisition must be signed by the requisitionists and deposited at the registered office of the Company at least six weeks or if later, the time at which notice is given of the annual general meeting before the annual general meeting, the Company has a duty to give notice of such proposed resolution to all shareholders who are entitled to receive notice of the next annual general meeting.

In addition, requisitionists may require the Company to circulate to shareholders entitled to receive notice of the annual general meeting a statement of not more than 1,000 words with respect to the resolution to be proposed. However, the Company is not required to circulate any statement if the court is satisfied that this right is being abused to secure needless publicity for defamatory matters. In such event, the requisitionists may be ordered to pay for the Company’s expenses for application to the court.

If the requisition signed by the requisitionists does not require the Company to give shareholders notice of a resolution, such requisition may be deposited at the registered office of the Company not less than one week before the next annual general meeting.

Convening Extraordinary General Meetings

Pursuant to Section 566 of the Companies Ordinance (Chapter 622 of the Laws of Hong Kong), shareholder(s) holding not less than 5% of the total voting rights of all shareholders having a right to vote at general meetings of the Company as at the date of deposit of the requisition, may request the Directors of the Company to convene an extraordinary general meeting. The requisition must state the objects of the meeting and must be signed by the requisitionists and deposited at the registered office of the Company.

If the Directors do not, within 21 days from the date of deposit of the requisition, proceed duly to convene a meeting to be held not more than 28 days after the notice of the meeting, shareholder(s) requisitioning the meeting, or any of them representing more than half of their total voting rights, may themselves convene a meeting to be held within three months of such date.

Meetings convened by the requisitionists must be convened in the same manner, as nearly as possible, as meetings to be convened by Directors of the Company. Any reasonable expenses incurred by the requisitionists will be reimbursed by the Company due to the failure of the Directors duly to convene a meeting.

Putting Forward Resolutions at Extraordinary General Meetings

Shareholders may not put forward resolutions to be considered at any general meetings other than annual general meetings. However, shareholders may request an extraordinary general meeting to consider any such resolution as described in “Convening Extraordinary General Meetings” above.

Any queries relating to shareholders’ rights on putting forward resolutions at general meetings and convening extraordinary general meetings should be directed to the Company Secretary of the Company. Requisitions should be deposited at the Company’s registered office and marked for the attention of the Company Secretary.

AMENDMENTS TO THE ARTICLES OF ASSOCIATION

To provide flexibility to the Company in relation to the conduct of general meetings, the Company’s shareholders passed a special resolution at the annual general meeting on 19 May 2023 approving certain amendments to the articles of association of the Company to, among other things, allow the Company to hold general meetings as hybrid meetings or electronic meeting where shareholders may attend and participate by means of electronic facilities in addition to physical attendance. The latest version of the articles of association of the Company is available on both the websites of the Company and the Hong Kong Stock Exchange.

CONTINUOUS EVOLUTION OF CORPORATE GOVERNANCE

The Company continuously analyses the corporate governance development of international advanced enterprises and the investors’ desires, review and enhance corporate governance procedures and practices from time to time so as to meet our shareholders’ expectations, commits to high standards of corporate governance and recognises that good governance is vital for the long-term success and sustainability of the Company’s business.

ENQUIRY ON THE COMPANY

Shareholders may raise any enquiry on the Company at any time through the following channels:

China Unicom (Hong Kong) Limited

Address: 75th Floor, The Center, 99 Queen’s Road Central, Hong Kong

|

Tel |

: |

(852) 2126 2018 |

|

Fax |

: |

(852) 2126 2016 |

|

Website |

: |

|

|

|

: |

These contact details are also available in the “Contact Us” section on the Company’s website (www.chinaunicom.com.hk) designated to enable shareholders to send enquiries to the Company on a timely and effective manner.